Federal Tax Authority announced earlier on 5th March 2018, regarding waiver of registration penalties of AED 20, 000. The deadline given for this AED 20,000 Fine waiver was till 30th April 2018.

FTA already made clear in the press release that it takes about 20 days for the registration process and hence businesses were given a time of more than 50 days.

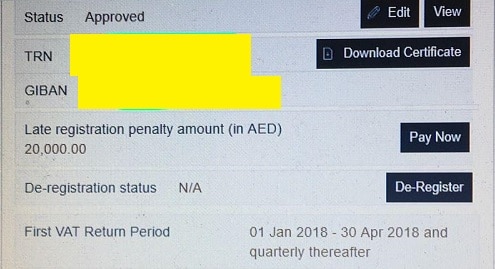

Many companies filed their registration process and recently received their TRN as well as certificates. In addition, when they logged on to the FTA portal, they noticed AED 20,000 fine on them. This fine is due to noncompliance of deadline of 30th April 2018.

Many of our readers contacted us for the issue mentioning the issue that ” our company is new and how can we receive the fines?” and thus we found the need to write this article.

See image below:

Federal Tax Authority clarified that any natural or legal person conducting business in the UAE is required to register for VAT if their taxable supplies exceeded AED375,000 in the last12 months or are expected to exceed such threshold within the next 30 days. Taxable Supplies are identified as all supplies of goods and services made by a Person that are not exempt, in addition to imported goods and services.

Source: www.tax.gov.ae

There could be two reasons for such fines:

- If you will apply for a company with revenue exceeding the mandatory threshold and effective date more than one month back, the company will be registered and there will automatically be a fine of AED 20,000 AED.

- You might have selected the effective date of registration as 01.01.2018 while submitting the application. Chances for the same are less, because while registration you need to submit the trade license copy.

This fine is not applicable to those companies who are new and obtained their trade license after 30th April 2018.

Penalties for not complying with VAT in the UAE?

AED 20,000

Failure of a taxable person to submit the VAT registration within the time frame (extended up to 30th April 2018).

AED 1,000

Failure for the first time in VAT Return Filing.

AED 2,000

Subsequent failure within 24 months for not Filing the VAT Return.

AED 15,000

Failure to display prices including tax.

AED 10,000

Failure in maintaining records for the first time.

AED 50,000

Subsequent failure maintaining the records.

For other administrative penalties click on the link below:

Tables of Violations and Administrative Penalties

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you.

Leave a Reply